How to Avoid Customer Alienation

Customer loyalty is something hard to get, and easy to lose. At Point Credit Solutions, we value a client and debtors relationship. On behalf of our clients, we do everything we can to get to the bottom of the debtors payment issue. A huge mistake businesses make is poorly solving problems with delinquent customers. This results in not receiving any payment at all, and losing that crucial customer relationship. Let's discuss a few tips we use to preserve relationships with customers...

1. Dive into why they haven't made the payment

Sometimes, customers just need a reminder. Maybe they aren't very organized, thought their spouse paid, or were unhappy with the service. At this point, you must get in contact with the debtor. If you can get them on the phone, it is essential to remain friendly and understanding. After all, we are all human and mistakes do happen. If there is an honest discrepancy in the product or service that was preformed, it is crucial to get proof of it. Ask for a receipt, photos, or offer a credit/discount towards their next purchase with your company.

2. Avoid harsh tactics

The friendlier you are, the greater success you're going to have collecting the amount owed. Chances are, if they owe you money, they probably owe a handful of other people money too. Many traditional collection agencies use dishonest threats to get people to pay leading to customer alienation. We believe that people want to pay their bills, and we help them do that by employing techniques designed to educate.

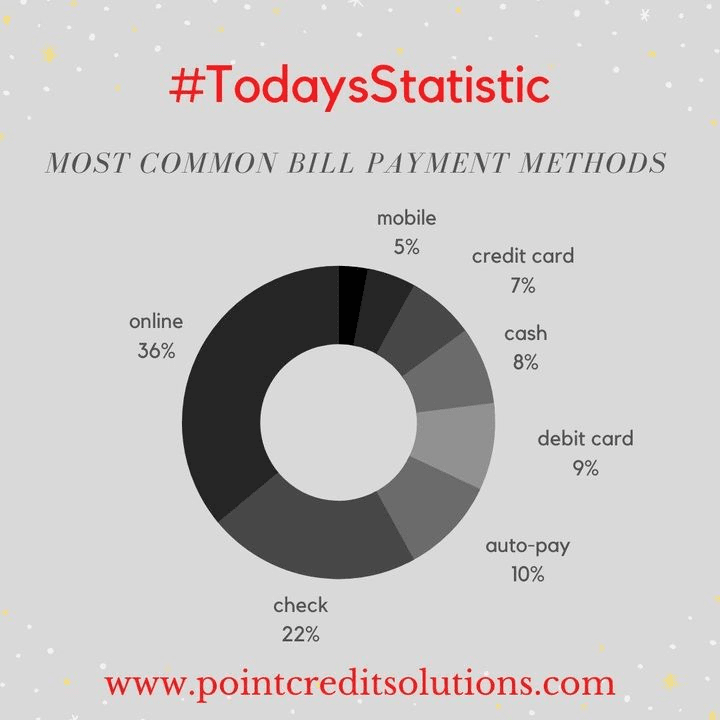

3. Make it easy for them to pay

Many debtors work long hours, moved to another state, are going through financial hardship or can only pay minimal ways. We have found great success in having a 'make a payment' link on our website which allows people to pay from anywhere, and at any time. We also allow debtors to enroll in a custom payment plan if they are going through financial hardships which could be due to a job loss or medical emergency.

4. Help them solve their problems

Sometimes people feel overwhelmed with bills or other life challenges. Becoming a priority can happen by just offering a little bit of empathy towards the customer, rather than force. By helping them see that you are human and understand, you automatically become the priority. When people have to choose between several past due bills that they need to pay and someone asks them with an empathetic and understanding voice, or brings payment solutions, the customer generally feel a sense of relief in solving the past due account.

If you would like our help managing past due and delinquent accounts receivable, click the "Get Started Now" button below to have a consultant explain how we recover accounts at a rate more than times the national average! We can help!

Bella Debo